- Home

- YouTube

- Blog

-

AJ's Favorite Things

-

Referral Links

>

- M1Finance

- Webull

- SoFiMoney

- SoFiInvest

- Public

- Robinhood

- Firstrade

- CashApp

- Ebates

- Rakuten

- Drop

- Dosh App

- GetUpside

- Pei App

- Bits Of Stock

- Bumped

- iBotta

- Credit Karma Savings

- Credit Karma Tax

- Lively HSA

- PolicyGenius

- Chase Sapphire Preferred

- Discover

- Visible Wireless

- Ting Mobile

- Xfinity

- Coinbase

- NordVPN

- Windscribe

- LastPass

- SoFiLoans

- TradeApp

- Motif

- Betterment

- Financial Freedom Webinar

- Financial Freedom Summit

- Slide App

- Gatsby Options Trading

- Yotta Savings

- Books

-

Referral Links

>

- Privacy

- About

- Contact

- Shop

|

Want to benefit from the rise of Bitcoin, without actually creating a Digital Wallet or setting up an account with a Cryptocurrency Exchange? Or alternatively setting up your own mining rig and earning bitcoin from supporting the network with your own miner? For some people, just getting started with Bitcoin is a hassle in itself, some new thing you have to learn and likely are only getting in because of the hype. But there are alternatives to actually buying or mining your own bitcoin directly. If any of these fit you, and you're willing to invest in a publicly traded company as a proxy to Bitcoin, there are a few companies with large Bitcoin holdings that you can buy on almost any stock investing app. Here are the Top 6 Stocks with Bitcoin Holdings you can buy, ranked by the number of Bitcoins they hold.

#6 Coinbase - $COIN

Coinbase, ticker symbol COIN, is the largest and most well known way for you to directly buy and hold Bitcoin in the United States. The have an iOS and Android app that makes it easy to create a digital wallet to hold Cryptocurrencies or trade them, whether you're buying Bitcoin or using the wallet as a way to send and receive cryptocurrency from others. It is also now a publicly traded stock with its IPO in April of 2021. Surprisingly Coinbase is not the largest holder of Bitcoin, or even in the Top 5, despite being the most popular way to buy Bitcoin directly. You can think of Coinbase as the TD Ameritrade or Robinhood of Cryptocurrencies. Coinbase currently holds a little over 4 Thousand Bitcoin as of their last Quarterly report in May of 2021, which was their first as a publicly traded company. Coinbase at the time of this post, is a $52B company, but is down 26% year to date.

Coinbase's Bitcoin Holdings Value Based on Price per Coin:

#5 Marathon Digital Holdings - $MARA

Marathon Digital Holdings, ticker symbol MARA, owns the 5th most Bitcoins of publicly traded companies, with 5 Thousand Bitcoins. MARA was previously known as Marathon Patent Group, which is the parent company of Uniloc, a well known "patent troll company". Essentially what the company does is sue other companies for patent infringement, which is why they are called a patent troll. However the parent company is now known for being one of the largest Bitcoin Miners, and one of the largest public holders of Bitcoin. MARA is a $3B company, is up 190% YTD, and 3228% over the past 12 months.

MARA's Bitcoin Holdings Value Based on Price per Coin:

#4 Square Inc - $SQ

Square Inc, ticker symbol SQ, the 4th largest publicly traded company to hold Bitcoin, is a holder of over 8 Thousand Bitcoin. Square is mostly known for their mobile payment platform, which allows you to place their Square reader in the headphone jack of an iPhone, and use the reader to accept credit card payments directly from your phone! Since then Square has expanded to POS Systems for small and large businesses, and created the wildly popular money transfer app called Cash App! Cash App also now allows you to buy shares of stock, including fractional shares for as little as $1 or $10 for recurring purchases. You can also buy Bitcoin in Cash App as well! The CEO of Square, Jack Dorsey, is also the CEO of Twitter. Square is a $111B company, is up 10% YTD, and 112% over the past 12 months.

Square's Bitcoin Holdings Value Based on Price per Coin:

#3 Tesla - $TSLA

Now we're moving into the Top 3, and each of these companies owns more than all of the previous companies combined! The third largest holder of Bitcoin for a publicly traded company is Tesla, ticker symbol TSLA, with over 43 Thousand Bitcoin! Tesla is mostly known as being the most popular and well-known Electric vehicle. They are seen as the leaders in the movement to Electric vehicles, as well as technology behind driverless cars. Elon Musk, the CEO of Tesla, recently jumped on the Bitcoin train in 2020 after having a conversation via Twitter with the CEO of the #2 Company on this list. And if you were to look at the stock chart of both of these companies, their chart looks almost identical. Tesla is a $654B company, is down 3.79% YTD, but up 180% over the past 12 months.

Tesla's Bitcoin Holdings Value Based on Price per Coin:

#2 Microstrategy - $MSTR

Which takes us to number 2. If you were to add up all the Bitcoin held by all of the companies mentioned so far in this video, it would still be less than what this company holds. Microstrategy, ticker symbol MSTR, currently holds 105 Thousand Bitcoin! Nearly 2.5X that of Tesla. Outside of being the largest holder of Bitcoin for any publicly traded Business, Microstrategy is a provider of enterprise analytics software and services. The CEO Michael Saylor decided in 2020 that he would use the companies cash on hand, as well as borrow additional cash by issuing Bonds, to build up this treasure chest of Bitcoin. He believes that holding Bitcoin is better than holding Cash, because we know that cash will be worth less a year from now, and every year in the future, due to inflation. Bitcoin however can stay the same or grow in value, although It can also lose value. Given his average holdings of Bitcoin are a little above $25K per Bitcoin at the moment, his strategy has returned over 20% given a $30K value of Bitcoin. MSTR is a $6B company, is up 63% YTD, and up 441% over the past 12 months.

Microstrategy's Bitcoin Holdings Value Based on Price per Coin:

#1 Grayscale Bitcoin Trust - $GBTC

Last but not least, is a non-operating business, an ETF called Grayscale Bitcoin Trust ticker symbol GBTC, which currently holds 607 Thousand Bitcoins! This ETF is available on many brokerages, but not all. It is currently the closest thing to directly owning Bitcoin, that you can get within the Stock Market. Due to this the volatility, the ups and downs, of this ETF are very similar to Bitcoin. It does not mirror bitcoin exactly, as at times you may either purchase GBTC at a discount or a premium compared to directly purchasing Bitcoin, but it's the closest you're going to get in a publicly traded stock at this time. GBTC's market cap is $20B, is down 18% YTD, but up 187% over the past 12 months. Just last week Morgan Stanley purchased over 28K shares of GBTC.

Grayscale Bitcoin Holdings Value Based on Price per Coin:

However there may be more options on the way later this year. Speaking of which, here are a few bonus details for current and potentially future ways you can benefit from the gains of Bitcoin. Bonus - ARK Invest: Cathie Wood

Recently Cathie Woods, the CEO of Ark Invest, submitted an application to create her own Bitcoin ETF which will likely be similar to $GBTC. If approved, the ticker symbol for her Bitcoin ETF will be $ARKB. Approval or Denial is expected before the end of this year. But right now you can invest in Cathie Woods Ark Innovation ETF, ticker symbol $ARKW. This ETF holds 48 different Internet and Technology related stocks, of which includes Coinbase, Square, Tesla, and Grayscale Bitcoin Trust. That's right, you can own 4 of the top 6 companies who hold Bitcoin, just by owning the ARKW ETF from Ark Invest. These 4 stocks are all in the Top 12 Holdings of the ETF, and account for 21.82% of the total ARKW Holdings as of June 25th 2020. ARKW is only up 2.96% through the first half of 2021, but is up 71% over the past 12 months.

Many Alternative Options

There you have it, 7 different ways to own Bitcoin and benefit from the rise of Bitcoin without creating a Digital Wallet or opening an account with a Cryptocurrency Exchange. If you're familiar with how to invest in the stock market, and don't want to take the time to learn how to buy Bitcoin directly, or don't want to take direct risk yourself, owning the stocks mentioned in this video is a great alternative which also allows you to minimize direct risk in ownership.

You also get the added benefit of growth from those stocks primary sources of revenue, which may smooth out the ride and lower volatility in comparison to the price moves of Bitcoin. However if you are interested in directly purchasing Bitcoin, and earning some interest on your holdings, checkout my referral links for Coinbase and BlockFi to open an interest bearing Cryptocurrency wallet! What do you think about this alternate strategy to benefit from Bitcoin through publicly traded stocks? Would you rather own Bitcoin directly, own a Bitcoin ETF, or own a company which holds Bitcoin as a proxy way of investing in Bitcoin? Which company, either on this list or not, do you think will become the next Billion Dollar Buyer of Bitcoin? Let us know your thoughts in the comments below.

Comments

BlockFi Review - Earn up to 7.5% Interest on Digital Currency with a BlockFi Interest Account4/14/2021

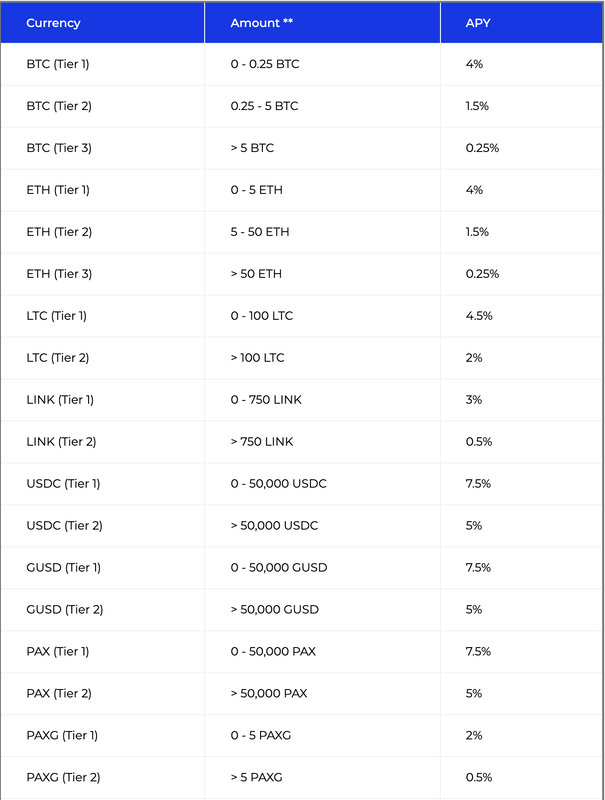

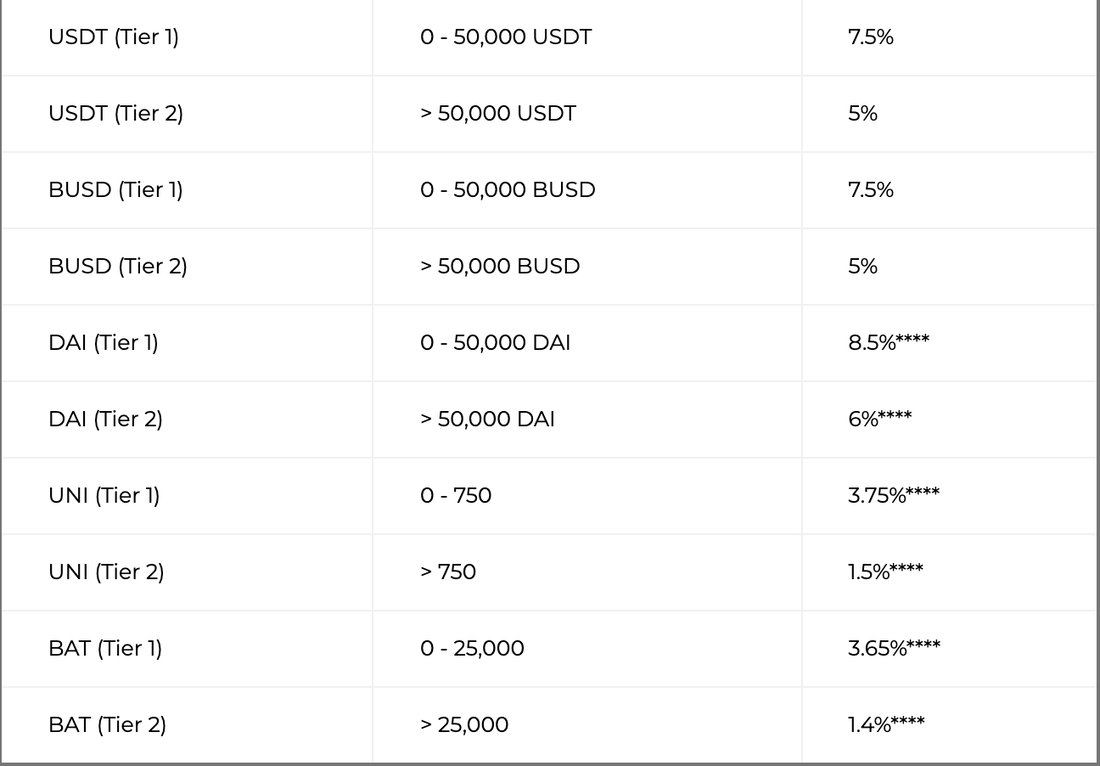

Looking for a way to earn interest on your stagnant savings? Well here's an option I found which is an alternative to your typical savings account, but also provides an even higher rate of return than what you would receive even from some of the non-traditional online/app only savings accounts I've mentioned in the past. One of these options is with BlockFi. Now BlockFi is a Fintech company which focuses specifically on Digital Currencies, also known as Cryptocurrency. By holding your eligible Cryptocurrencies in a BlockFi Interest Account, or BIA for short, you can earn rates as high as 7.5%!

(updated as of July 2021) Earn High Interest

Earn interest as high as 7.5% on stablecoins and other cryptocurrencies. You can also receive your interest payments in the form of a specific cryptocurrency if you choose! By default you will receive your interest payments in the same form as the cryptocurrency you hold within BlockFi, however if you would like you can have all of your interest earnings paid in a specific coin of your choosing like Bitcoin. Your interest yield will be based on the coin type you hold in your account, not based on what coin you choose to be paid in. So for instance you can hold GUSD and receive the 7.5% rate while receiving your payment in BTC. This is a great way to grow or start your Bitcoin holdings without actually buying into Bitcoin directly if you don't want to. Essentially turning your savings into an automated monthly purchase of Bitcoin with money you may already have sitting in a savings account elsewhere. For some people this would be a way to limit their risk, while also adding a little exposure to the world of cryptocurrencies.

Yield Hunting

I just bought a football team...no seriously I'm now a part owner of a football team. But it's not the NFL, it's the FCF. FCF stands for Fan Controlled Football, which is a league that allows the fans to become part of the game. Not only that, but they allow the average Joe to become an owner as well! I like to think of this as real life Madden Franchise Mode.

You may be thinking, AJ, what does this have to do with Investing or Finances in general? Well this is an Alternative Investment. An Alternative Investment is when you invest your money into something other than the stock market. Bitcoin for example, to some, is considered an alternative investment, even though it was created to be a Currency. Gold, Silver, and Real Estate are all Alternative Investments. And investing in Startups like the FCF League is an alternative investment. In this post, not only will I tell you about the FCF League and why I invested into it, but I will also tell you how you can invest in Alternative Investments if you're interested. What is Fan Controlled Football?

Robinhood is in hot water with its customers after recently stopping trading in GameStop, as well as other stocks many people in the reddit forum Wall Street Bets had their eyes on. Many are now looking for Robinhood Alternatives, and even started the hashtag #DeleteRobinhood. I've even personally noticed an uptick in the views of my Investing Tutorial videos for other investment apps. There are also Apps who are moving away from the Payment for Order Flow model, and/or providing account transfer bonuses, in order to appeal to those who may be disgruntled.

I'll give you a list of brokerage accounts which can provide you with many of the same features as Robinhood. So first I'll talk about what are the main features that attract people to Robinhood, and what other brokerage accounts can offer you some of the same features. User Friendly Mobile App One of the main things that attract users to Robinhood is the easy of use, or user friendliness of the app. Now I would say that what one person considers user friendly will vary, so almost every app in this video is an app that I would personally consider user friendly. That leaves 5 specific features that I want to focus on for this list of alternatives. 1) Free Trading 2) Fractional Shares 3) Automated Share Purchases 4) Options Trading 5) Cryptocurrency These are 5 features Robinhood offers which I believe make it a very attractive app, whether you are a new or seasoned investor. Here are the apps you may want to consider which provide some of these same features. This is not a head to head ranking of which app is the best investment app, I will start off with the apps that provide at least 2 of the 5 features mentioned above, increasing the number of matching features as we go along. Matches 2 of 5 FeaturesHow to Turn $25 Into $10,000,000 or a Tesla Model 3! - Yotta High Yield Savings Account Review10/7/2020

Want to know how you can turn $25 Into $10,000,000 or a Tesla Model 3? While also keeping your $25? Checkout the Yotta Savings Account! Yotta Savings is a new High Yield Savings Account which takes a well known approach to convincing people to part ways with their money...the lottery! But this is so much better than an actual lottery, because you don't lose your money if you don't win! Here's how it works...For every $25 deposited into your Yotta Savings account, you will receive 1 ticket into a weekly jackpot for the chance to win $10 Million! Yes that's right, for $25 you can get a chance at $10 Million dollars. But before I break down how to win, and what the odds are, I want to reiterate that this is actually a savings account, and even without the lottery aspects...it's a pretty good one considering the super low interest rates at the moment. I think Yotta is banking on the fact that many people would rather have their savings with Yotta, even at the current rates, vs taking a risk in the stock market or sitting their money in another account with low interest...oh and of course a chance to win $10Million Dollars!

High Yield Savings Account

The Slide App is made by the same company as the Raise app, used for buying and selling used or unwanted gift cards. So it’s not surprising that the Slide app takes a gift card purchasing approach with its Cash Back App! Similar to another cash back app I recently reviewed, the Fluz App, the Slide app works by purchasing gift cards within the app, then using those gift cards to pay for your purchases. With many cash back apps the amount of cash back from one store to the next will vary. So if you use a lot of different cash back apps, you may have to bounce from one to the next to see which app will give you the greater amount of cash back. Now if you use the Slide app, you know exactly how much cash back you will receive, so you just need to know which stores are available within the app! Well Slide has over 150 stores available to shop from within their app, and there’s no limit to the amount of cash back you can earn!

Also, if you choose to add funds to your Slide balance in advance, meaning just having a balance sitting in the app, you can earn an extra 1% in cash back! This seems like it could be a waste at first glance, considering it would be better to just make the gift card purchase at the time you are actually shopping. But have you seen interest rates at the moment?!?!? There are many banks that don’t even provide 1% in interest at the moment, and by adding cash to your Slide balance, you are essentially earning 1% on the cash you have sitting in this account, in addition to the 4% cash back you will receive for your actual store purchase! Didn’t think about that, did you? But don’t fully treat it like a savings account, you really just want to put money in here that you are planning to shop with anyway. So if you have a set budget for eating out or shopping for the month, and the stores you typically use are available in the Slide app, this would also be a great way to stick to your budget. Almost like a cash envelope system that earns you cash back! How to Use Cash Back

Slide has one of the lowest thresholds for withdrawing your cash back at just $15. Since all transactions have a 4% cash back rate, then you know exactly how much you’ll need to spend in order to earn enough cash back for withdrawal, $375. Many people spend that much each month between online shopping, eating out, and grocery shopping.

Once you spend $375 in total, reaching your $15 cash back minimum threshold, you can use Venmo or PayPal to withdraw your cash. Another option would be to use your cash back balance for future purchases, essentially giving you $4 worth of free purchases for every $100 you spend. In the spirit of the raise app, I wanted to add an old gift card I received as a rebate, and use that to add to my Slide slide balance. This earns me a total of 5% cash back since I’m adding it to my balance, vs going direct to a gift card purchase for a particular store. This old gift card had a balance of $12.82 left on it, so I couldn’t actually use it here. When adding a balance to your account, you have to add a minimum of $25 up to $1000 to your Slide Cash Balance. However when choosing individual stores for the regular 4% cash back, each store will have their own minimum gift card purchase amount. Most are either $5 or $10 as the minimum purchase amount. Cash Back Stacking Strategy

Since Slide requires you to purchase gift cards for your purchases, this limits your cash back stacking options. But have no fear, AJ Mobile Money is here to help you navigate the cash back stacking possibilities.

With every cash back stacking strategy, the 1st and most important factor is starting with a Cash Back Credit Card. Since the Slide App won’t allow you to qualify for any special categories for restaurants, travel, etc..then you want to use the credit card with the highest amount of General Cash Back. For me that’s the Citi Double Cash Card. With the Citi Double Cash Card I earn 2% Cash Back in ALL purchases, no matter the category! This means that on EVERY purchase I make using Slide, I can earn a minimum of 6% and a maximum of 7% cash back!

The Fluz Cash Back App is taking a Network Marketing / Multi Level Marketing (MLM) angle to earning cash back. Typically I'm not a fan of anything that even mentions MLM or Network Marketing, but I do love cash back apps, so I decided to check it out. At first glance, it's really just a Cash Back App, so I'll start there to show you how to earn Cash Back using Fluz. If you're interested in the Network Marketing portion, be sure to checkout my video overview of the Network Marketing opportunity to see how you can earn cash back from people you invite, plus the people that they invite, as well as bonuses once you reach certain levels, thus the Multi Level component of the app.

How Does It Work?

Do you buy Gas at Shell? If so, you're going to want to watch the above video until the very end...or just keep reading down below! In this video I will show you how you can maximize the amount of cash back you receive whenever you buy Gas at Shell with my Cash Back Stacking Strategy.

Level 1: Credit Card: 2.5% to 6.5%

With every cash back strategy you need to start with a Cash Back Credit Card. My preferred credit card for buying gas is the Costco Visa Card, because you get 4% Cash Back at ALL gas stations...not just at Costco! This is a great all around credit card, but I'll spare you those details here. Checkout my review of their card at a later time.

There are many credit cards you could use at Shell, but none that Shell themselves would prefer for you to use other than their own Shell Fuel Rewards Credit Card. I don't personally have this card, but it does provide a few great benefits which may be worth having if you ONLY use Shell Gas. Shell has two versions of their credit card. The first is the Shell Rewards Fuel Card. This card can only be used at Shell, so it does not help with this stacking strategy, you would need to select the Shell Fuel Rewards Mastercard by Citi. The Mastercard version of their card allows you to use it wherever Mastercard is accepted, but also allows you to connect it with the Apps we will use later in this stacking strategy. So what are the benefits? As a Shell Fuel Rewards member you save 5 cents per gallon at the pump, but when you use the Shell Fuel Rewards Mastercard to pay for gas, this bumps up your savings to 10 cents per gallon. There is a limit of 20 gallons per fill up for this discount. When you first sign up for either of the cards, you get 30 cents off per gallon for your first 5 gas purchases. As of this post, gas in my area is just above $2 per gallon. When considering the first 5 purchases that's about a 15% discount per gallon on 5 fill ups. On an ongoing basis using the 10 cent discount, that's continuous 5% discount! Of course gas can increase or decrease as supply and demand changes, but as long as gas stays in the range of $1.50 to $4.00 you will get between 2.5% to 6.5% cash back every time you fill up your tank. If you tend to use different gas stations every now and then, then getting a credit card with another company, like Costco, Citi, AMEX or others would be a better deal since you would have the additional benefits that their card would provide in other categories like Restaurants, Travel, or just overall general cash back at a higher rate. The Mastercard version of Shell's credit card does provide additional rebates of 10% at Shell for non-fuel purchases, 2% on Dining and Groceries, and 1% on all other purchases. Those rebates are applied as statement credits on your credit card, and work essentially the same as any other cash back credit card. The only difference is you can't actually get the cash returned to your own bank account. This is why a regular cash back credit card would provide additional benefits in the flexibility of how you can use the cash back. Now that you know how to either earn a discount or receive cash back, let's go on to level 2! Level 2: Get Upside: .50% to 7.5% Cash Back

Depending on your selection in Level 1, you may or may not have the opportunity to earn cash back with GetUpside. If you use Shell Fuel Rewards to get a discount on your gas, whether you are using their credit card to get 10 cents off per gallon or just getting the 5 cents per gallon discount with a non-Shell credit card, then you can't use GetUpside. I repeat...GetUpside and Shell Rewards do not work together! So my suggestion would be to determine which option is best for you, but for me personally, using my Costco cash back credit card is the best option for allowing me to stack my rewards, including working with the GetUpside App!

With GetUpside you can earn cash back at Shell, as well as other gas stations, by linking your credit card to their app, selecting a participating gas station within their app, and earning cash back either automatically or by uploading your receipt shortly after your purchase. Cash back can range between 1 cent to as high as 15 cents or more on average from what I've seen. The main difference between Shell Fuel Rewards and GetUpside is that Shell provides a discount per gallon, while GetUpside gives you cash back. Some may prefer to get the discount because you pay less up front, vs paying 5 cents more to get maybe 15 cents per gallon back in cash. I would say choose which ever option works best for you! In most cases, depending on how much cash back is offered at your local Shell gas station, GetUpside ends up being the better deal in the long run. The only downside is you have to wait for your cash back to build up to at least $25 before you can withdraw it from GetUpside. So there's the immediate gratification of the Shell Rewards discount, or the delayed gratification of more cash back via GetUpside...choose wisely! On average in my area, GetUpside allows me to earn between .50% to 7.5% cash back on each fill up. In addition to this, anyone that joins GetUpside using my referral link will receive a 15 cent per gallon bonus on their first fill up.! Level 3: Bits of Stock App: .50%

The 3rd level is the Bits of Stock App, where you can earn cash back which is then used to purchase shares of stock. Essentially a Stock Back App! The Bits of Stock App allows you to select 15 companies in any category. So if you don't only buy gas from Shell, you could also select Exxon, Chevron, or BP to earn your stock back bonus! Each time you make a gas purchase using a linked Credit Card, you will earn .50% cash back on each purchase which is then used to purchase the stock of Shell. Let's say that the average gas tank size is 15 gallons, and gas is currently $2 per gallon. Your $30 fill up would earn you 15 cents worth of Shell stock. If you need to fill up every week for that same amount, this means that over the course of a year you could earn about $7.80 in Shell stock. That's about 1/4 of a share based on Shell's current stock price. Shell stock also pays a dividend, whose yield is around 4% paying $1.28 per share every quarter. So in addition to the immediate bonus of receiving Stock Back from Shell, Shell's stock will also pay you a dividend for owning their stock, and you have the potential upside of Shell's stock value increasing over time. All you needed to do was purchase gas as you normally would! If you would like to add Bits of Stock to your cash back stacking strategy, use my referral link!

Level 4: Bumped App - .50%

On the 4th level of this cash back stacking strategy is the Bumped App. Just like with the Bits of Stock App, with the Bumped app you receive cash back on all of your purchases which is used to purchase Stock. The main difference between the Bumped app and the Bits of Stock app is that the Bumped app only allows you to select 1 company per category, and Gas is one of the available categories. When you select Shell as your cash back option for gas, you can earn .50% stock back. With the Bumped app, instead of receiving Shell stock, the stock you receive is the Vanguard Total Stock Market Index Fund ETF (VTI). If you've watched any of my investing videos in the past, then you know this is one of the ETF's I personally choose for passive stock investing. I have an IRA with M1 Finance which I post monthly updates on my Instagram page, check me out at AJMobileMoney on Instagram. So personally I do like being able to choose VTI as my stock back option, and there are other companies which give you this option as well within the Bumped App.

All together, once you consider the 4 levels of cash back you can earn buying gas at Shell, you're looking at a minimum of 4% up to as high as 15% back in combined cash/stock back using this strategy. Since I get an automatic 4% cash back with my Costco Credit card, I personally average around 8.5% total cash/stock back on every gas purchase at Shell.

If you like this strategy, be sure to checkout my Cash Back Stacking Strategy Playlist for more places you can earn significant cash back just like this! Also look out for more stores which I'll add to this list so you can maximize rewards on every purchase you make!

References:

Motif Investing is closing down as of May 20th 2020. If you choose to do nothing, your accounts will transfer to Folio Investing, and this process will be automatic. However, you do have the choice to choose a new brokerage account for yourself instead. As a former Motif user myself, here's why I think M1 Finance would be the best choice for your next brokerage account. Let's discuss some of the Similarities and Differences between Motif Investing and M1Finance.

Similarities

Motifs vs Pies:

With Motif and M1 Finance you can select pre-made portfolios, combine pre-made portfolios to create a hybrid, or create your own portfolio! Motif Investing called these Motifs, while M1 Finance calls them Pies. This allows you to select multiple companies you would like to invest in, and purchase them all in one transaction. This was a game changer when Motif Investing first offered this to the public, and I jumped at the opportunity! This essentially allowed you to create your own Index Fund or Mutual Fund like portfolio. I used Motif Investing for over 5 years, up until I started using M1 Finance last year. Fractional Shares: The great thing about both platforms is the ability to deposit a small amount of money, while being able to buy into the companies you believe in. No matter the price! This means that for as little as just $1 you could buy into high priced stocks like the MAGA Stocks: Microsoft (over $200), Amazon (over $2K), Google (over $2K), Apple (over $200) per share. Differences

Lower Minimum Buys:

With Motif in order to add more money to your motif, you needed to either have the paid subscription to automate it, and you needed to buy-in with a minimum of $250 each time. With M1 Finance you only need $100 to open your account or $500 for a Traditional or Roth IRA, however once your pie is rolling, you only need a minimum of $10 to add money to your pie, and $1 per individual stock or ETF within your portfolio. Recurring Income: No bonuses for other users buying your pie, other than the current referral bonus available at the time if a new user joins based on you sharing your pie with them. This is one feature I liked about Motif, as you could make several portfolios, and whenever other users bought into your portfolio you would receive commission. It was a small amount at just $1-$2, but something that you could continue to receive even after their initial purchase if they continued to put money into it. Rebalancing and Reinvesting Dividends: Motif didn't offer rebalancing free of charge. All trades within M1 are free, whether you are buying, selling, or rebalancing. You have the ability to reinvest your dividends, as long as your cash balance is above $10. You can setup automatic reinvestment of your dividends into your whole pie, not just back into the stock that paid the dividend, once your total cash balance is over $10. You can set a higher cash balance threshold if you choose. No Fees: M1 Finance is essentially Motif, without the trading fees! Although you can upgrade to the M1 Plus account if you would like an additional afternoon trading window to make your purchases. Otherwise, your trades can only go through once per day if you put in your order before 10am EST. Why M1 Finance? Pretty Much the Same App, with less limitations, more automation, and no fees! Instead of a maximum of 30 stocks or ETFs in a Motif, you have a maximum of 100 stocks or ETFs in a your M1 Pie. Both have the option to automate your investing, add money to your fund in order to rebalance back to the levels you set for each stock or group of stocks, and allow you to purchase fractional shares! Balance Transfer Bonus: If you transfer a balance of greater than $100K, you will receive at least a $250 Bonus, up to a $2,500 Bonus. This bonus lasts through the month of May. Folio Investing vs M1 Finance

The alternative you have to selecting your own new brokerage is to go with the new owner of Motif accounts if you take no action before May 20th, and that is Folio Investing. Is M1 Finance a better platform than Folio Investing? Well one of the major differences is that Folio Investing will charge you fees, when M1 Finance is essentially the same as Motif and Folio Investing but without the fees? What does FolioFirst have to offer?

Basic Plan: Similar to Motif and M1 Finance, with their Basic Plan you can invest in groups of stocks and ETFs called Folios. Just like M1 Finance, Folio Investing also allows you to invest in up to 100 total stocks or ETFs within your Folio. There are 160+ ready to go folios that you can choose from. However Folio Investing charges $15 per quarter, and charges $4 per trade. Unlimited Plan: With the unlimited plan, you can make up to 2000 "commission free trades", so you don't have the individual $4 charge per trade. However you are charged $29 per month instead of $15 per quarter for this plan. Or you can save slightly by paying $290 for the annual plan, saving you 2 months worth of fees. However, that's still almost $300 per year in fees, compared to ZERO fees with M1 Finance. The one feature Folio Investing has, is the ability to make market, limit, stop, and stop-limit orders...for a fee of course! If you have the basic plan it is $10 per trade or $3 per trade with the Unlimited Plan. With M1 Finance you have only 1 trade window per day with it's free basic account, or 2 windows if you choose to upgrade to their M1 Plus Account. The M1 Plus upgrade has a few other features as well, like a high yield cash management account, and the ability to borrow against your investments. These are not features I personally use, but may be of interest to others.

So what's keeping you from switching to M1 Finance? It's essentially a free version of Motif with less limitations and no fees! If you're a passive investor, and like to automate your investments into the individual stocks or ETFs you are interested in over a the long haul, then this is the perfect time to switch to M1 Finance!

I have a referral link available in the description and comment section below, so let us know what you think in the comments below. If you're a current or former Motif user, let us know what decision you made in the comments below. Did you stick with Folio Investing? Did you switch to M1 Finance? Or did you choose an alternate route, and if so what brokerage did you choose?

Recently I was asked how I was able to remember all of the passwords for all of the accounts I have. As members of the Mobile Money Nation know, I review a lot of different financial accounts, most of which I actually open accounts with to test out their app first hand. Trying to create different passwords for each site, that are difficult to guess, yet easy to remember, would be nearly impossible if I relied just on my memory.

Saving my passwords in a notebook, sticky note, or in a note app on my phone wouldn't cut it either. That's a potential security and privacy nightmare. These could be easily stolen by someone eventually, giving access to all of my accounts. With all of these financial accounts, email addresses, and the 10s to 100s of apps that many of us use on our smartphones, a password manager is essential! Create Your "Last" Pass Word!

I started using LastPass about 5 years ago. With several email addresses, financial accounts for myself as well as my family, and a parent who has trouble remembering their passwords as well, it was getting overwhelming to try to remember every password without using the same password over and over again.

With LastPass all you have to remember is ONE PASSWORD. That is the password you use to login to the LastPass website, application on iOS & Android, or when using the extension in Chrome, Internet Explorer, or Safari. Once you're logged in you can access passwords for all of the websites and applications you use. You can even leave notes for yourself in the Secure Notes vault. Use this if you need to save any special instructions related to a particular website, credit card numbers, wifi passwords, or even for contingency planning if needed. Pretty much anything that you used to use a sticky note for, this is the area where you can save this information. What's even better is you can use LastPass to create stronger passwords. Since you won't necessarily need to remember your passwords anymore, you can use their randomizer to make longer harder to guess passwords, that meet all of the criteria of most websites these days...as far as the length, special characters, and number requirements of the password you create. LastPass Premium

LastPass Premium Account is just $3 per month, billed annually for $36 a year. This allows you to store an unlimited amount of passwords for every account you have. Think about all of the email accounts, websites, apple ID, Android logins, social media accounts, bank accounts, brokerage accounts, work logins, doctor or other health account logins, retirement accounts, your kids or parents accounts, your spouses accounts, grandparents, and whatever or whoever else I may be forgetting. In fact take a quick scroll through to see all of the apps installed on your smartphone. That's a lot of passwords to remember! And you can't just make your password "PASSWORD" and expect to survive in this almost totally digital economy with hackers working 24/7 to find an easy target.

Features

Form Fills:

Tired of typing your name, shipping address, billing address, phone number, email, and other information into fields online whenever you're signing up for a new service, making an order, or setting up a new account? You can safely save default information that you'll use over and over again into the form fill section of LastPass. This can include credit card information if you don't like to setup new accounts for online retailers every time you shop online, or fill out a survey. Just setup your form fill, and you're just a few clicks away from filling in all of this information instantly. If you're an online shopaholic...maybe this is a bad idea! You may not want to be able to get to checkout that fast! Security Challenge: The Security Challenge section is an area that can help you with increasing the security of all of the accounts that are saved in LastPass. LastPass can analyze the complexity of individual passwords, as well as let you know if you've used the same password too many times across multiple accounts. If someone were to figure out your password for one account, they would definitely try that same password to try and login into any other accounts they're able to find. With Security breaches happening essentially all the time now in this digital world, your password could have been stolen from one of the many websites you log into, and then sold on the dark web. Just search on your favorite search engine for the phrase "recent security (or data or privacy) breaches" and you'll certainly find one related to an account you use! PrivacyRights.org is also an excellent source to keep up with recent breaches. A great feature with the Security Challenge section is that if you do have a lot of overlap, or a lot of passwords that are easy for hackers to guess, you can run the Security Challenge and receive a score on how susceptible you may be based on your password choices. Then you can change the passwords to all, or most of your online accounts in one click! You will get a list of recommended changes for: Compromised Sites, Weak Passwords, Reused Passwords, and Old Passwords which have not been changed in a long time. With some of the websites you will have the option to select a checkbox for those sites, and let LastPass change the passwords on all of those site in one click by running a script it uses for those sites. If LastPass has any issues changing the passwords, or if the sites show up in the list of sites they're unable to automatically change, just click on the "launch site" button. This will allow you to go to each site manually and change the password. Now that your'e using LastPass, I would recommend just using the random password generator since you won't ever need to remember anything other than the password to log into the LastPass app and Browser Extension. Family Plan

LastPass Family Plan makes it easy for families to share passwords, either on a permanent basis, or emergency basis. With the Family Plan, you can have up to 6 Total users all for just $4 a month! Each user has their own login to LastPass, so you don't have to share your main login password with each family member if you were all using the same account in the past. One of the issues you would run into if you were to use the regular premium account with multiple people, on multiple devices, is that you may be asked to login into LastPass again. But also with multiple people needing to remember the same password, it's much easier to just have a different password for each individual user. You as one user will already have multiple devices you have to account for, so don't add more by sharing one Premium Account! For desktop/laptop use, LastPass essentially gives a specific device in a specific location access for 30 days. You can name the device as well, that way if you need to check login history to ensure no one has access to your account that shouldn't, you will be able know because you may be asked to verify your login via email. You can also setup the LastPass Authenticator app, or a 3rd party App like the Google Authenticator, to use as two factor authentication (2FA). I personally use the Google Authenticator app, but this is more because I was already using this app for access to other websites and applications prior to starting the use of LastPass. Using the LastPass Authenticator is much more efficient, because it will automatically recognize the LastPass Authenticator which can be setup for push notifications. With Google Authenticator you'll need to open this app separately, then enter the current code into your browser or phone in order to authenticate your login session. You won't need to do this on a regular basis, only if you log into LastPass from an unrecognized device or location.

Sharing Passwords: In addition to having access for 5 additional users for just $1 more than the premium account, the main feature that stands out for the Family Plan is Sharing passwords. If there are certain logins that you want all, or just some, of your family to have access to, you can setup Sharing Folders for those accounts. Passwords related to your finances, taxes, medical, insurance, or even just entertainment accounts can be shared with the whole family or just certain members. You can even setup a folder for your kids email or social media accounts. Or maybe a folder for that forgetful family member, or non-tech savvy family member you're always helping with online activities. It's definitely worth the extra $1 per month to get all of your family's password lives in order, instead of keeping all of this information in your head or on a sheet of paper that others can easily access.

So for any of you out there who need help keeping up with your passwords, or want an easy to use tool to keep your passwords safe, and make them more difficult for snoopers to guess and use, checkout LastPass Premium or LastPass Family. It's been a really useful product for me. If you have any questions about the product, my experience, or you would like to share your experience, be sure to let me know in the comments below!

Related Content: YouTube Blog |

AJ Mobile MoneyHusband | Father | YouTuber | Former ATLien Subscribe!Disclosure: Some of the links throughout my site are Affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase or sign up for certain accounts. Affiliate links help to run this site!

Archives

July 2021

Categories

All

|

Copyright © 2019